CRV

Curve DAO Token

$0.5133

4.96%

Curve DAO Token Price Converter

Curve DAO Token Information

Curve DAO Token Markets

Curve DAO Token Supported Platforms

| 1CRV | ERC20 | ONE | 0x352cd428EFd6F31B5cae636928b7B84149cF369F | 2021-07-05 |

| ABCRV | ERC20 | ARB | 0x11cdb42b0eb46d95f990bedd4695a6e3fa034978 | 2021-06-17 |

| CRV | ERC20 | ETH | 0xd533a949740bb3306d119cc777fa900ba034cd52 | 2020-08-12 |

| CRVE | ERC20 | AVAX | 0x249848beca43ac405b8102ec90dd5f22ca513c06 | 2021-09-09 |

| ECRV | ERC20 | NRG | 0xd3319EAF3c4743ac75AaCE77befCFA445Ed6E69E | 2021-03-03 |

About Curve DAO Token

Curve DAO Token (CRV) is the governance token of the Curve Finance protocol, used to incentivize liquidity providers and engage more users in the governance of the protocol. CRV is used for voting, staking and boosting, allowing users to acquire voting power and earn a boost of up to 2.5x on the liquidity they provide. CRV holders can stake their CRV to receive trading fees from the Curve protocol, and 50% of the trading fees are distributed to veCRV holders. Curve Finance was created by Michael Egorov, the CTO of NuCypher, a computer and network security company. Curve Finance is an automated market maker protocol designed to facilitate the swapping of tokens with low fees and slippage, and its pricing formula is designed to minimize slippage as much as possible. The max supply of CRV is 3.03b and was officially launched on the 13th of August 2020.

Curve DAO Token (CRV) is the governance token of the Curve Finance protocol. It is used to incentivize liquidity providers on the Curve platform as well as engaging more users in the governance of the protocol. CRV is used for voting, staking and boosting. Vote locking CRV allows users to acquire voting power and earn a boost of up to 2.5x on the liquidity they provide. CRV holders can stake their CRV to receive trading fees from the Curve protocol and 50% of the trading fees are distributed to veCRV holders. The max supply of CRV is 3.03b and it is distributed to community liquidity providers, shareholders, employees and the community reserve. CRV was officially launched on the 13th of August 2020 and the circulating supply was 0 at launch. With the help of scripts, users can initiate the burn process to convert trading fees into 3CRV and distribute them to veCRV holders.

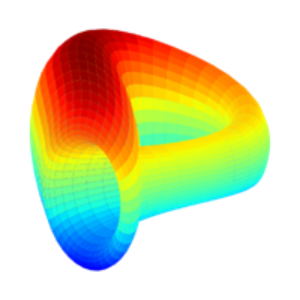

In short, Curve Finance is an automated market maker protocol designed to facilitate the swapping of tokens that remain in a relatively similar price range, with low fees and slippage. It is a decentralized liquidity aggregator where anyone can add their assets to several different liquidity pools and earn fees. The pricing formula used by Curve is designed to minimize slippage as much as possible between the different tokens.

Curve Finance was created by Michael Egorov, the CTO of a computer and network security company called NuCypher.